Advanced accounting - Dolibarr

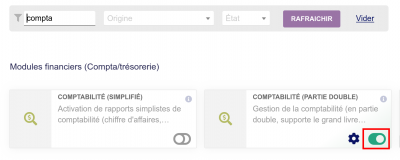

Activation of advanced accounting and choice of chart of accounts

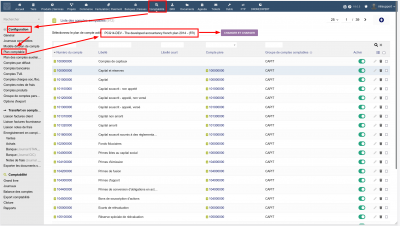

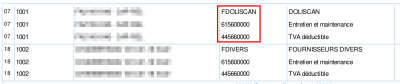

Then configure the accounting system. Don't hesitate to copy and paste the list of accounts and ask your accountant which codes to use: on the export he gave you, only the accounts currently in use appear …

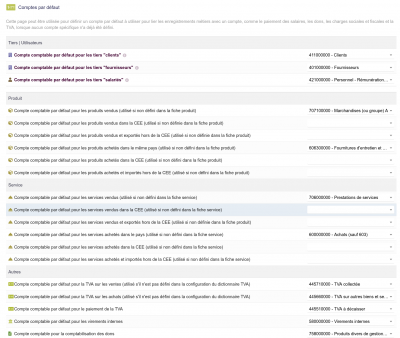

Also configure:

- VAT accounts

- Company/tax expense accounts

- Expense accounts

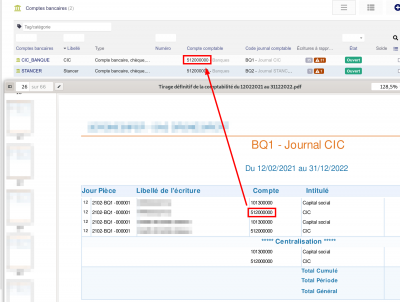

Then go to the bank accounts and check that the code matches that of your accountant.

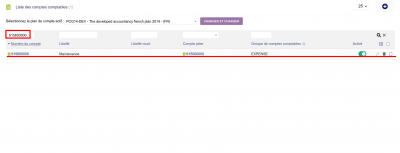

Checks and additions according to your chart of accounts

If you already have an initial balance sheet in your hands, you can/should transfer the accounting codes that your chartered accountant has used. The aim is to be able to provide him with an FEC file at the end of the year, which he can then import into his software and “find his little ones” …

You then have to “juggle” between your balance sheet or the documents sent by your chartered accountant and your Dolibarr to check that the codes used exist and add them if necessary.

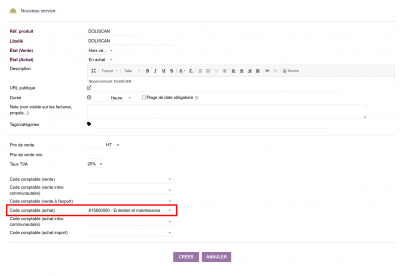

Automatic allocation to products and services

Now that your chart of accounts is “complete”, you can take the necessary steps to ensure that your purchase and sales invoices “embark” products and services that are configured with the appropriate accounting codes. This will ensure that your invoices are correctly paid into your accounts.

For example, with our 615600000 “DOLISCAN” account, which corresponds to purchases, you can create (or modify if it already exists) the DOLISCAN service to associate this accounting code with it.

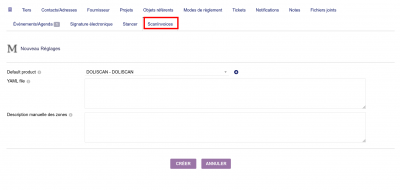

The DoliSCAN service is marketed by CAP-REL, so it makes sense to have a CAP-REL Third Party in your Dolibarr database.

And if you only have one product / service purchased from this supplier, you can associate it by default with the automatic import of supplier invoices via ScanInvoices.